Following article explains how reports are counted and data is persisted.

Values are counted with 6 fraction position precision.

As a general data is saved when transaction is finalized and later setup changing, for example product category, doesn't effect reports. Only exception is that when transaction is deleted or returned.

Only columns that are not self explanatory are described.

Report values can be presented with date or shift (business date) filters.

Press End Shift to signal End of Day.

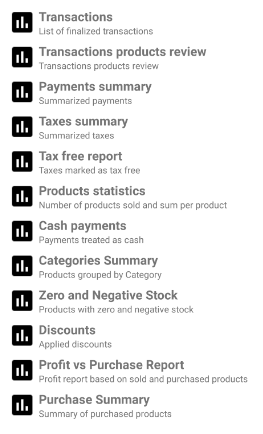

Report: Transaction list

Click transaction to show preview of this transaction details

Columns explained:

Sum - total value of transaction with tax

Without tax - total value of transaction without tax

Tax - total value of taxes in transaction

Date time - finalized time stamp

Report: Transaction details

Columns explained:

Qty/val - quantity of products | value of tax

Value - gross transaction sum | gross price * qty | payment value

Net val/taxable - net transaction sum | net price * qty | taxable | net payment

Report: Transactions products review

Products are listed in order they were entered

Columns explained:

Price is saved for the moment of transaction finalize

Value equals price with tax * qty

Report: Payment summary

Values are counted proportionally to payment value for shared payments

Columns explained:

Qty - number of payments of specific payment type

Report: Taxes summary

Columns explained:

Sum - sum of tax counted as percent of net price * product quantity

Taxable - sum of values used as base for tax counting, when multiple taxes apply value is added multiple times to this collector

Qty - quantity of tax applications